GARCH MCMC

Time Series Volatility

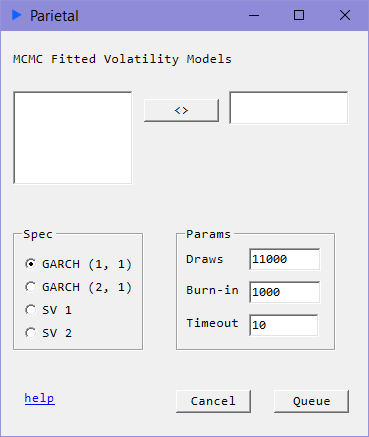

Description

Fitting GARCH models via maximum likelihood estimation can sometimes be a bit tricky. Here we offer an alternative using markov chain monte carlo for GARCH(1, 1) and GARCH(2, 1) models.

Model: GARCH(1, 1)

Model: GARCH(2, 1)

We recommend using 100 * (log returns) as input series for numerical stability reasons.

Input

- draws: Run the sample this many times.

- burn-in: Discard these many samples from the beginning draws. Burn-in must be less than draws.

- timeout: Time limit in minutes.

Returns

- coef: Coefficient estimates for for GARCH parameters and for ARCH parameters

- serr: Standard Errors

- : volatility process